22.01.2024

Global Ocean Carriers Halt Red Sea Transits – What to Expect

Global Ocean Carriers Halt Red Sea Transits – What to Expect

Updates on the Suez Canal: Red Sea Situation May Be Driving Higher Airfreight Tonnages

3 pm ET / 12 pm PT, Wednesday, January 24

The situation in the Red Sea may be influencing year-over-year air cargo tonnages.

Air cargo volumes have rebounded so far in early 2024, surpassing last year's trends. We’ve seen global air cargo tonnages increase in the second week of January 2024, rising by 24% compared to the previous week. This counters the typical end-of-year slowdown. The current rebound is notably more pronounced than the same period in the previous year, with a marked increase in cargo from Asia Pacific and Middle East & South Asia to Europe, potentially influenced by shipping disruptions in the Red Sea.

Call outs

- According to US Central Command, on Jan. 24 the Houthis fired three anti-ship ballistic missiles from Houthi-controlled areas of Yemen toward the U.S.-flagged, owned, and operated container ship M/V Maersk Detroit, transiting the Gulf of Aden. One missile impacted in the sea. The two other missiles were successfully engaged and shot down by the USS Gravely . There were no reported injuries or damage to the ship.

- As of Jan 24, ~562 carrier vessels accounting for ~7.6 million TEUs of capacity (almost 25% of global capacity) are actively diverting, will divert, or have already diverted the Suez Canal. We expect this number of vessels to increase at a more modest pace following previous updates as carriers are proactively designating diverted vessels earlier. This was expected as the situation continues without a clear resolution in sight.

Red Sea Impact on Asia to Europe:

- After the continuous rate increases in the past month we are seeing some market rate decreases as demand cools down for the Lunar New Year weeks.

- Two more void plans announced by carriers led capacity for weeks 8 and 9 to be cut by more than 25% on average. As a result of vessels rerouting via Cape of Good Hope, vessels and containers face longer transit times.

- Expect a shortage of empty containers in Asia in the coming weeks, especially in smaller feeder ports.

- To mitigate the disruption of operational challenges (sailing schedule adjustment, vessel downsizing, equipment shortages etc.), shippers can explore higher cost premium services for guaranteed space and equipment to shorten delays.

Updates on the Suez Canal: A Comparison of the Current Red Sea Situation Versus the Covid-Era Market

6 pm ET / 3 pm PT, Monday, January 22

During the Covid-era supply chain crisis of 2020-2022, global ocean carriers and ports alike made major infrastructure and capacity improvements. These investments were a response to aging fleets and a need to modernize, as well as the extreme demand surge that was at the root of the logistics bottlenecks we saw at almost every major port in the world.

Now, against the backdrop of the protracted situation in the Red Sea, these capacity and infrastructure improvements are all coming online. While these improvements have certainly helped lessen the severity of the current crisis, it’s these improvements coupled with substantially lower demand levels that has lessened the current rise in rates and transit times relative to the rates seen in the 2020-2022 period.

How the Red Sea Situation Compares to the Covid-Era Market

- The Covid-era shipping crisis, from about 2020-2022, saw a massive demand shock where import levels increased ~20% relative to historical years. A demand boom stresses every single node in the logistics network from origin factory, to vessels, to ports, to trucking, to destination warehouses. When all of these are impacted, the entire system slows and large whipsaw effects are seen. Conversely, the current Red Sea situation has caused a supply shock, and, more specifically, has impacted ocean vessel capacity. Some other nodes in logistics networks are impacted, but not to a comparable degree.

- Vessels diverting around the Cape of Good Hope created a capacity shock largely concentrated to ocean vessel capacity; coupled with the over-supply of capacity seen in the market in the second half of 2023, the market was able to naturally absorb a certain amount of the impact. Before the Red Sea situation, carriers were blanking 10-20% of sailings due to the lack of demand. This means there was excess supply in the market that could be plugged back into the network to compensate for extended transit times of services.

- However, not all vessels were in the right place. Deploying a new vessel on a string costs money, which is why rates have increased.

- By the numbers, ocean container vessel capacity increased 4.8 million TEUs, or 20%, from January 2021 to January 2024 as the vessel order spike seen in 2020-2022 began to deliver to the market. There will be another 3 million TEUs, or 10% of the current global fleet, delivered in 2024 of which 71% of capacity are from vessels >7.5k TEUs in capacity and will likely service the major east-west trades.

- On the port side, there have been incremental improvements in specific ports to increase throughput. For example, the Port of Los Angeles and Long Beach have invested in increased on-dock rail capacity (10,000 more TEU per week) and train lengths, truck gates available seven days a week, new cranes in three terminals, and increased dock space at International Transportation Terminal (ITS) and Long Beach Container Terminal (LBCT). This will improve origin and destination services and performance.

Updates on the Suez Canal: European Tradelanes Remain Most Impacted

6 pm ET / 3 pm PT, Friday, January 19

As of Jan 19, 552 carrier vessels accounting for ~7.6 million TEUs of capacity (almost 25% of global capacity) are actively diverting, will divert, or have already diverted the Suez Canal. We expect this number of vessels to increase at a more modest pace following previous updates as carriers are proactively designating diverted vessels earlier. This was expected as the situation continues without a clear resolution in sight.

All European-bound trade lanes remain impacted due to the situation in the Red Sea. On the Transpacific Westbound and FarEast Westbound, we continue to see delays. As reported in FreightWaves on Jan. 18 the situation in the Red Sea has “fundamentally changed the supply-demand equation” for at least the first quarter of 2024. Further, Flexport’s manager of ocean procurement, Connor Helm, shared that “Carriers are committed to going around the Cape of Good Hope. They’re no longer waiting to see if this situation is going to be mitigated. It’s very clear that this is going to be a kind of long-term situation and carriers are reacting that way.”

Callouts:

- According to US Central Command, on Jan. 18 the Houthis launched two anti-ship ballistic missiles at M/V Chem Ranger, a Marshall Island-flagged, U.S.-Owned, Greek-operated tanker ship. There were no reported injuries or damage to the ship and it continued to its final destination.

Transatlantic Westbound:

- Market demand has remained relatively stable in January with no spikes expected until March at the earliest.

- Overall capacity remains high despite an anticipated 20% decrease on average for January and February due to blank sailings. We expect carriers to pull more capacity in the coming weeks to help with the Red Sea situation. We’ve already seen members of the Ocean Alliance and 2M (Maersk and MSC) doing this.

- As a direct impact of the Red Sea situation, rates for vessels traveling on Transatlantic routes have started to increase, and are expected to increase further in February when most carriers announce GRI/PSS and emergency surcharges.

FarEast Westbound:

- Market demand is moving up for the second half of January and all ships are filling up. Week 3 spot rates slightly increased due to the Lunar New Year rush and week 4 spot rates are stabilizing at high pre-Lunar New Year levels.

- As the Red Sea crisis continues, it’s now estimated for a vessel to take 2-4 weeks (round trip) depending on the destination. As a direct impact, Ocean Alliance and 2M announced 15+ void plans for February with more to be expected from THE Alliance soon.

Equipment shortages can be expected in the coming weeks if the situation remains the same.

Mediterranean:

- Following North Europe, MED spot rates for the second half of January are increasing in week 3. Week 4 spot rates are expected to be slightly lower as carriers are pushing cargo to fill up ships before the Lunar New Year.

Updates on the Suez Canal: Equipment Issues Loom as Lunar New Year Approaches

1 pm ET / 10 am PT, Thursday, January 18

Lunar New Year begins Feb. 10, 2024 and is a milestone in the annual freight cycle. Typically, there’s a peak in the market as shippers try to move their goods before manufacturing in China shuts down for the holiday. Carriers will proactively position containers to capture the post-holiday ramp up.

This year, however, we could see equipment shortages and containers out of position due to vessels rerouting around the Cape of Good Hope. Robin Corlett, VP of Ocean Freight Development at Flexport, explained in the most recent Economics of RFP Season, that the extended transit times of 8-21 days have displaced containers that should be in China to meet the post-holiday demand, but won’t be.

We’re already seeing equipment issues with 20 ft containers and high cubes, and shippers should be prepared to pay a premium for containers if they want their goods quickly after the holiday.

As for prices, there’s no resolution for the situation in the Red Sea on the horizon. As nearly every single carrier and vessel operator is diverting around the Cape of Good Hope, spurring longer transit times and downstream equipment issues, we anticipate almost every industry to be impacted. The Suez Canal is a main thoroughfare for the oil and gas industry; expect higher prices not only at the pump for consumers, but for transportation carriers, too. Carriers will pass along those higher fuel costs in their freight rates, which will trickle down to consumers.

Callouts

- According to US Central Command, on Jan. 17, a one-way attack was launched from Houthi controlled areas in Yemen and struck M/V Genco Picardy in the Gulf of Aden. M/V Genco Picardy is a Marshall Islands flagged, U.S. owned and operated bulk carrier ship. There were no injuries and some damage reported. M/V Genco Picardy is seaworthy and continuing underway.

- A follow-on contribution to rising rates, according to Lars Jensen, CEO & Partner at Vespucci Maritime, is the lack of feeder capacity. Cargo that was bound for the Red Sea prior to the crisis was suddenly disrupted, and a large amount of cargo got stuck in major hubs across Asia without sufficient feeder capacity from niche operators to move the cargo onwards into the Red Sea. This has caused rates to surge as well as created congestion issues in the impacted ports.

- As of Jan 18, 549 carrier vessels accounting for ~7.5 million TEUs of capacity (almost 25% of global capacity) are actively diverting, will divert, or have already diverted the Suez Canal. We expect this number of vessels to increase at a more modest pace following previous updates as carriers are proactively designating diverted vessels earlier. This was expected as the situation continues without a clear resolution in sight.

Updates on the Suez Canal: Freight, Insurance Rates Projected to Continue Increasing

7 am ET / 4 am PT, Wednesday, January 17

Rates continue to increase as a result of the ongoing situation in the Red Sea. While rate indices typically lag behind the rates we’re seeing in the market, there’s been a large week-over-week increase on the Shanghai Container Freight Index (SCFI) for the Shanghai to North America lanes in particular. The Jan 12 SCFI publication showed a week-over-week increase on Shanghai to the US West Coast of 43% or $1,199 per FEU and Shanghai to the East Coast of 48% or $1,882 per FEU.

Insurance rates have increased, too. According to GCaptain, insurance for vessels transiting the risk areas of the Gulf of Aden and Red Sea has increased ~10x over the past few weeks after bumping up after the recent military strikes in the region. Rates are now anywhere from 0.75% to 1% of the value of the vessel, translating to $1-2.5 million for vessel insurance depending on the age, size, and type of vessel.

The heightened insurance rates can actually make the Cape of Good Hope routing more cost effective for carriers relative to the Suez Canal despite the higher fuel costs.

Callouts

- Several events have transpired over the past 72 hours in the risk regions around the Arabian Peninsula. United Kingdom Maritime Trade Operations reported multiple occurrences of small boats approaching commercial vessels in the Red Sea and Gulf of Aden. Between January 15 and 16, two different bulk vessels were hit by missiles in the Red Sea and Gulf of Aden. Both vessels are seaworthy and are proceeding to the next port of call. Over the past few days US military forces continued strikes on missiles that were prepared to launch on the coast of Yemen and seized advanced conventional weapons.

- As of Jan 16, 549 carrier vessels accounting for ~7.5 million TEUs of capacity (almost 25% of global capacity) are actively diverting, will divert, or have already diverted the Suez Canal. We expect this number of vessels to increase at a more modest pace following previous updates as carriers are proactively designating diverted vessels earlier. This was expected as the situation continues without a clear resolution in sight.

Updates on the Suez Canal: U.S. Central Command, the United Kingdom, Australia, Canada, the Netherlands and Bahrain Conduct Joint Strikes

11 am ET / 8 am PT, Friday, January 12

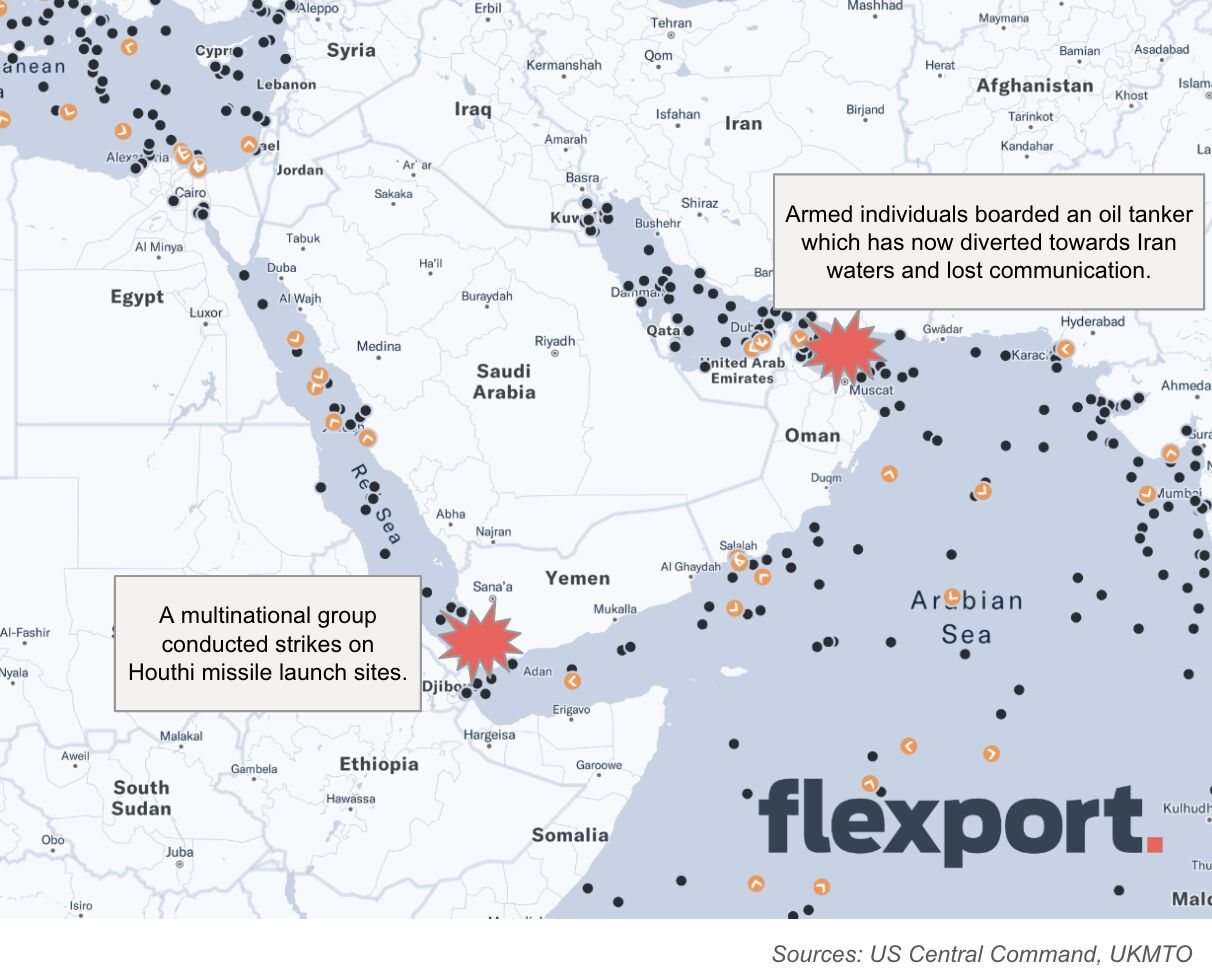

On Jan. 11, U.S. Central Command reported that its forces, in coordination with the United Kingdom, and support from Australia, Canada, the Netherlands, and Bahrain conducted joint strikes on Houthi targets as a result of the conflict in the Red Sea. This multinational action targeted radar systems, air defense systems, and storage and launch sites for one way attack unmanned aerial systems, cruise missiles, and ballistic missiles. These strikes have no association with and are separate from Operation Prosperity Guardian, a defensive coalition of more than 20 countries operating in the Red Sea, Bab al-Mandeb Strait, and Gulf of Aden.

Flexport is closely monitoring the situation and is in contact with all carrier partners. We’ll continue to provide updates as available.

Callouts

- The Baltic and International Maritime Council (BIMCO), a shipping association representing ship owners that represents ~60% of the world’s tonnage, has advised its members of all industries to avoid the Red Sea area for 48-72 hours.

- We have already seen upwards of 15 vessels of all types (container, tanker, bulk, etc) that were heading towards the risk areas decide to turn away.

- As of Jan 12, the United Kingdom Maritime Trade Operations (UKMTO) reported a missile was fired towards a vessel 90 nautical miles south of Yemen in the Gulf of Aden. The missile landed in the water 500 meters from the vessel and was followed by 3 small craft. No injuries or damage is reported and the vessel is proceeding to the next port of call.

- Outside of the commonly discussed risk areas of the Red Sea and Gulf of Aden, on Jan 11, the UKMTO reported that 4-5 armed individuals boarded an oil tanker which has now diverted and lost communication.

- As of Jan 12, 524 carrier vessels accounting for ~7.15 million TEUs of capacity (almost 25% of global capacity) are actively diverting, will divert, or have already diverted the Suez Canal. We expect this number of vessels to increase at a more modest pace following previous updates as carriers are proactively designating diverted vessels earlier. This was expected as the situation continues without a clear resolution in sight.

Updates on the Suez Canal: Expect Downstream Equipment Shortages by end of January

4 pm ET / 1 pm PT, Thursday, January 11

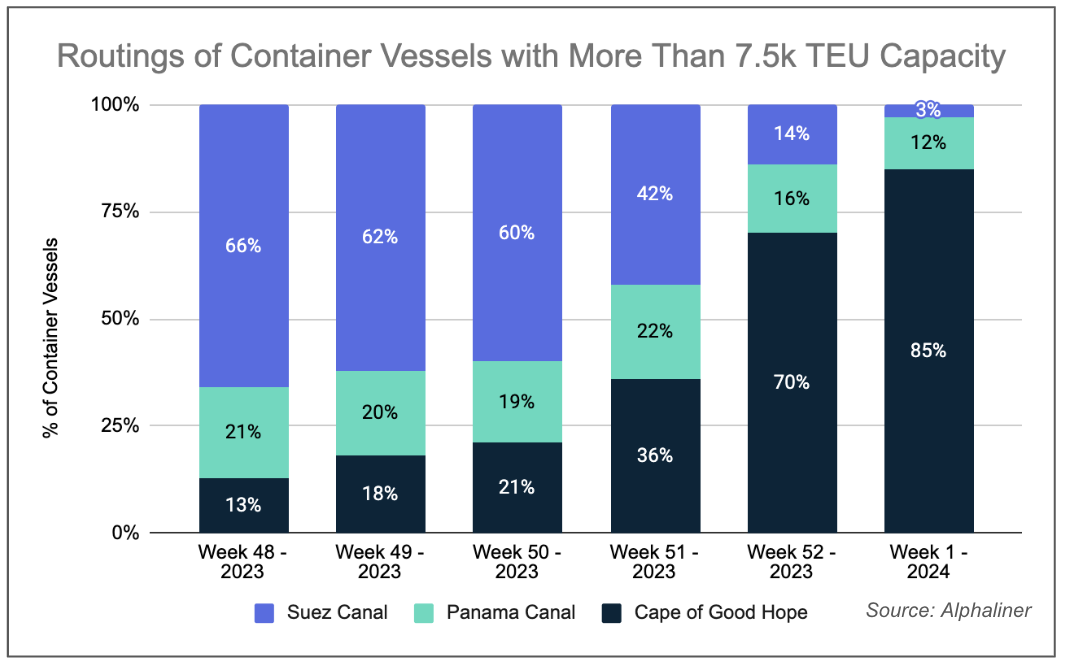

Data from Alphaliner shows that in the week of November 26 (week 48, 2023), about 66% of 7,500+ TEU container vessels were transiting the Suez Canal, while 21% transited the Panama Canal and only 13% navigated around the Cape of Good Hope. Following weeks of vessel diversions and Panama Canal slot restrictions, by the week of Dec. 31 (week 1, 2024) about 85% of the vessels were navigating around the Cape of Good Hope while only 12% transited the Panama Canal and 3% transited the Suez Canal.

Callouts

- As of Jan 11, 517 carrier vessels accounting for ~7 million TEUs of capacity (almost 25% of global capacity) are actively diverting, will divert, or have already diverted the Suez Canal. This is out of ~735 vessels that typically transit the Suez Canal, have been diverted from the Panama to the Suez Canal (due to draft restrictions causing limited transits), or newly added capacity to services typically utilizing the Suez Canal.

- On Jan 11 there were two separate events impacting the extended risk areas. First, United Kingdom Maritime Trade Operations reported that a vessel was boarded by 4-5 people off the coast of Oman and the vessel has since altered course and communications have been lost. Second, the US Central Command reported that Houthis fired an anti-ship missile into the Gulf of Aden. The missile was seen entering the water and no injuries or damage were reported.

- Based on conversations with our carrier partners, there’s no clear resolution date on the horizon and we expect vessel diversions to continue. In addition to the elevated rate levels we shared yesterday, shippers should be prepared for equipment shortages that will likely arise in the second half of January.

- Containers will be tied up on the water for longer periods and will not be in the areas they’re needed. Acute equipment shortages may lead to further rate increases as some shippers are willing to bid up rates to secure sailings.

- Further, as carriers continue to divert vessels and/or use alternative routes to deliver goods, vessels will likely start to bunch at ports that could lead to anchorage delays and increases to terminal dwell time.

- We haven’t seen a material increase in airfreight rates as it’s the post holiday low season after eCommerce demand in Q4 drove high prices. That said, shippers should plan for potential capacity constraints in the air cargo market as shippers look to solve inventory issues caused by extended ocean transit times. For context, a 747 cargo plane can only carry around seven ocean containers worth of cargo compared to 10,000+ for the mega container ships, so it won’t take many companies deciding to do ocean-to-air conversions to shift the market.

- All Flexport LCL shipments are offset on behalf of our clients by Flexport, which is especially important since we estimate emissions will double from some of these routing changes.

Updates on the Suez Canal: Diversions Causing Increased Rates Across Almost all Tradelanes

2 pm ET / 10 am PT, Wednesday, January 10

Ocean carriers are continuing to assess the safety of transiting the Suez Canal on a daily basis. On January 9, US Central Command advised they shot down 18 one-way attack UAVs (OWA UAVs), two anti-ship cruise missiles, and one anti-ship ballistic missile launched by Houthis. No injuries or damage was reported.

Simultaneously, Hapag-Lloyd shared that it had extended its decision to continue diverting around the Cape of Good Hope and will reassess on January 15. Flexport will provide updates on the status of Hapag-Lloyd diversions when available. CMA CGM remains the only major container carrier to transit the Red Sea.

Callouts:

- As of Jan 10, there’s been no material change in the number of vessels re-routing. Carriers have begun sharing diversion updates earlier than in the past as the situation persists. Currently, 517 carrier vessels accounting for ~7 million TEUs of capacity (almost 25% of global capacity) are actively diverting, will divert, or have already diverted the Suez Canal. This is out of ~735 vessels that typically transit the Suez Canal, have been diverted from the Panama to the Suez Canal (due to draft restrictions causing limited transits), or newly added capacity to services typically utilizing the Suez Canal.

- Shippers should note that if you need goods in the next three months, you’ll face higher rates. Due to shifts in capacity, we urge customers to determine whether they’d rather take on higher rates now, or manage through the equipment shortages post-Chinese New Year which could also lead to elevated rates.

- We’ll see this impact first with premium rates, which will come at higher levels to guarantee equipment and priority loading. Based on conversations with our carrier partners, some premium levels could exceed $10k per FEU from Asia into the US West Coast by January 15.

- It’s important to note that ocean freight prices are spiking even on trade lanes that aren’t directly impacted by Cape of Good Hope diversions like the Transpacific and Transatlantic. These diversions require longer transit times, which means more vessels are needed to service the same amount of demand. Carriers have pulled capacity from other lanes to support Asia to Europe.

- Rates continue to climb by the day from Asia to Europe, but are expected to increase an average of ~$1.5k per 40-foot container from the first half of January to the second half. Asia to North America saw smaller increases in the first half of January relative to Asia to Europe, but is catching up and rates are expected to increase $2-3k per 40-foot container from the first half of January to the second half.

Updates on the Suez Canal: Carriers Weighing Options to Restore Suez Canal Passage

2 pm ET / 10 am PT, Monday, January 8

As of January 8, there are 515 vessels accounting for 7 million TEUs of capacity that are diverting, will divert, or have diverted around the Cape of Good Hope. All major container carriers continue to avoid the risk areas with the exception of CMA CGM who is making routing decisions on a vessel-by-vessel basis based on many factors.

Callouts:

- On January 6, the United Kingdom Maritime Trade Operation (UKMTO) reported that 6 suspicious small crafts got within one nautical mile of a merchant vessel. Coalition forces assisted and the vessel and crew were all safe.

- For safety concerns, it appears that carriers have expanded the practice of turning off their Automatic Identification System (AIS), a GPS tracking system, from just the Red Sea and Bab el-Mandeb Strait to now include Somalia’s coast as well.

- Insurance costs for ships transiting the Red Sea have increased 3.5X since the attacks started in December.

Updates on the Suez Canal: Carriers Adapting Routing Decisions and Freight Rates Continue to Rise

11 am ET / 8 am PT, Friday, January 5

As of January 5, carriers maintain their routing south of Africa for almost their entire fleet with the exception of CMA which has continued using the Red Sea. Maersk, who previously elected to return to Red Sea transits and then paused, is now turning vessels away from the risk areas to transit the Cape of Good Hope. The Shanghai Containerized Freight Index’s (SCFI) publication shows rate increases, but not to the magnitude seen in the market.

Callouts:

- As of January 5, 389 container vessels accounting for 5.4 million TEUs of capacity (~22% of global capacity) are actively diverting, will divert, or have already diverted the Suez Canal. This is out of ~664 vessels that typically transit the Suez Canal.

- When considering carrier stances on Red Sea transits, it is important to note that vessel decisions are ultimately made by the vessel operator, and cargo with other carriers with slots on the vessel will be impacted by the decision. However, vessel-sharing agreements between carriers can influence the routing decisions of vessel operators as vessel utilization is key. For example, a vessel operator may be influenced by vessel-sharing agreements to use Cape Of Good Hope to maximize vessel utilization if their partners refuse to load on Red Sea vessels due to risk.

- The January 5th publication of the Shanghai Containerized Freight Index (SCFI) showcases the following increases:

- Shanghai to North Europe: +7% since Dec 29 and +179% since Dec 15

- Shanghai to the Mediterranean: +4% since Dec 29 and +131% since Dec 15

- Shanghai to U.S. West Coast: +9% since Dec 29 and +53% since Dec 15

- Shanghai to U.S. East Coast: +10% since Dec 29 and +40% since Dec 15

- While the SCFI shows increases, the magnitude is lower than what we see in the market. In times of high volatility, it is difficult for indices to keep up with the market freight rate changes. This was particularly apparent during the COVID economy. For example, the Drewry Container Index saw week-over-week increases of 115% from Asia to Europe and 25-30% from Asia to the U.S.

- Premium rates will come at higher levels to guarantee equipment and loading. We're hearing about some carriers announcing premium levels at over $10,000 per 40-foot container into the U.S. West Coast for the second half of January.

- Rate increases have cascaded into the Transatlantic trade as well as we saw Maersk announce a peak season surcharge and CMA announce a rate restoration initiative.

- To a certain extent, shippers have their hands tied if they need goods in the next three months. They can either accept high rates now or delay cargo and have to navigate equipment shortages post-Lunar New Year which will also lead to elevated rate levels.

Updates on the Suez Canal: Carriers Continue to Reroute Vessels To Avoid Attacks

1 pm ET / 10 am PT, Thursday, January 4th

Attacks on vessels in the Red Sea, Gulf of Aden, and coast of Somalia continue. On January 2, Houthi forces launched two missiles at CMA CGM Tage in the Red Sea. On January 4 at 10:25 AM EST, the United Kingdom Maritime Trade Operations reported that “5 to 6 unauthorized armed persons have boarded a merchant vessel” 460 nautical miles east of Somalia. Carrier routings continue to fluctuate with most avoiding the at-risk areas.

Callouts:

- As of today, 389 carrier vessels accounting for 5.4 million TEUs of capacity are actively diverting, will divert, or have already diverted from the Suez Canal as a direct result of these attacks.

- After Maersk’s decision on December 31 to re-pause transits through the high-risk areas, they are now diverting vessels that were idling south of the Gulf of Aden towards the southern tip of Africa.

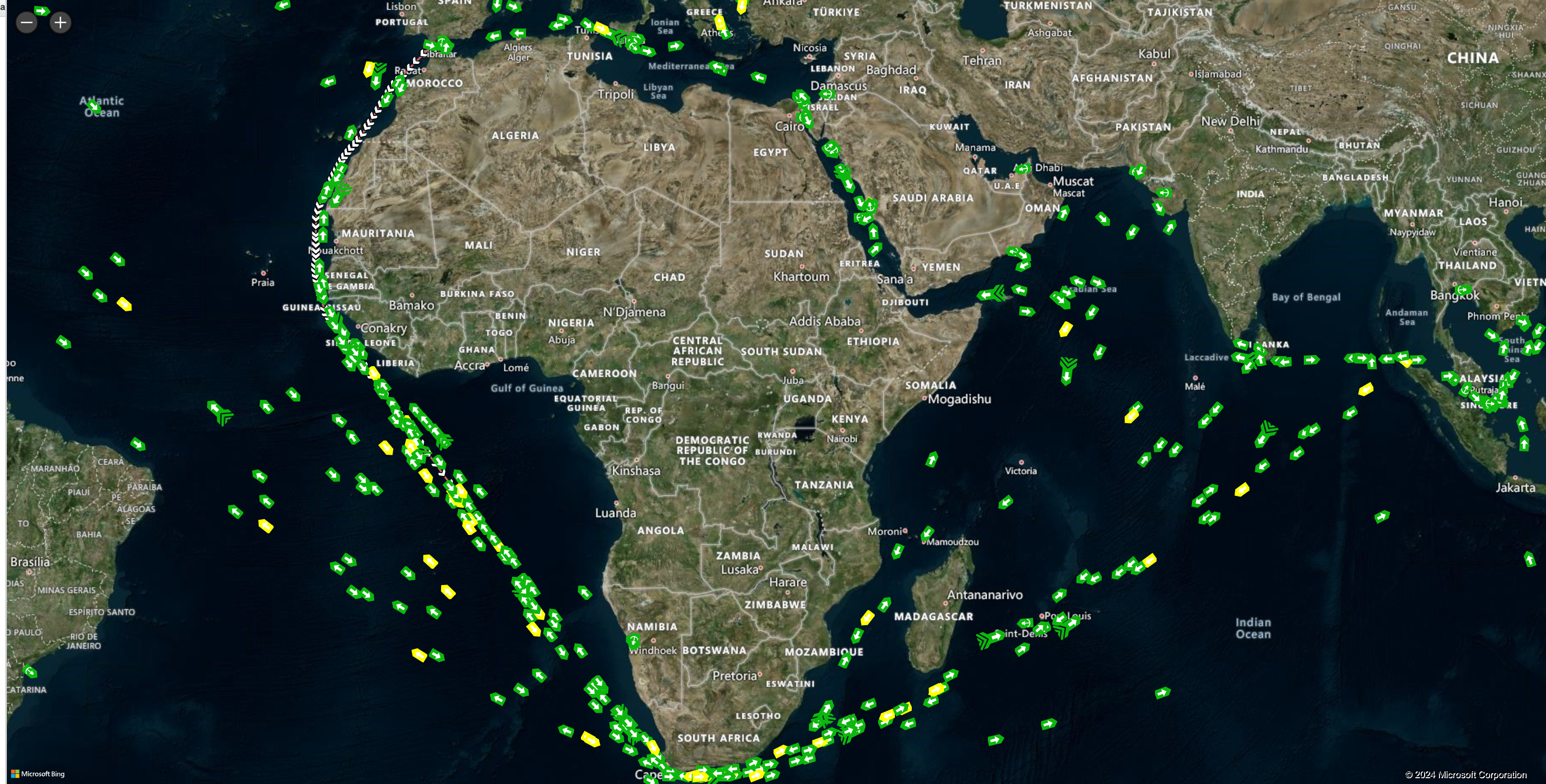

- COSCO is also now routing most vessels around the Cape of Good Hope but continues to assess on a vessel-by-vessel basis. See the below visual in which COSCO’s vessels are in yellow.

- Some carriers are deploying vessels that typically service other trades like Asia to North America and LATAM to Asia to Europe trades to compensate for service disruptions. Today alone, we saw 4 vessels across HMM and Hapag-Lloyd accounting for 33k TEUs of capacity that will be deployed on the Asia to North Europe and Mediterranean trades.

- Vessel deployment will help, but not solve capacity constraints. Equipment shortages at origin ports are expected to rise in the coming weeks as the impacts of service disruptions make their way downstream.

- The military coalition aimed at protecting the risk areas now consists of 12 nations. On Wednesday, the coalition warned Houthis of ‘consequences’ for continued attacks in the region. From the White House, “The Houthis will bear the responsibility of the consequences should they continue to threaten lives, the global economy, and free flow of commerce in the region’s critical waterways.”

Updates on the Suez Canal: Anti-Ship Missiles Fired Into the Southern Red Sea

12 pm ET / 9 am PT, Wednesday, January 3rd

On January 2, Houthi rebels fired two anti-ship missiles into the southern Red Sea. Multiple commercial ships reported feeling the impact of missiles into the water, but none have reported any damage. The attack took place approximately 33NM East of Assab, Eritrea according to the United Kingdom Maritime Trade Operations (UKMTO).

Major updates include:

- Hapag-Lloyd advised they will “continue to avoid Red Sea transits and reroute its vessels around the Cape of Good Hope until at least January 9,” after which they will reassess the situation.

- Maersk is still pausing Red Sea transits, with some vessels waiting on either end of the risk area while others have turned away from the area seemingly diverting towards the Cape of Good Hope. Maersk continues to assess the situation.

- CMA CGM and COSCO continue to send vessels through Suez.

- Vessel transit decisions are made by the vessel operator and cargo with other carriers having alliance slots on those vessels will be impacted by the decision.

- At this point, the Federal Maritime Commission in the U.S. has granted special permission to carriers to implement surcharges concerning the Red Sea situation effective now as opposed to the usual 30-day notice period.

Updates on the Suez Canal: Resurfaced Attacks on Commercial Vessels

2 pm ET / 11 am PT, Tuesday, January 2nd

Attacks on commercial vessels resurfaced with two attacks on the Maersk Hangzhou vessel on December 30 and 31. Tensions remain high, and most carriers have continued pausing Red Sea vessel transit or diverting around the Cape of Good Hope. The situation is fluid, and carriers will act quickly following risk assessments. Flexport is in constant communication with carrier partners to stay on top of the changes.

Callouts:

- Following the two attacks on Maersk Hangzhou, military presence from many surrounding nations is increasing and tensions remain high.

- On Dec. 31, Maersk paused Red Sea transits for a 48-hour period due to the two attacks of Maersk Hangzhou on Dec 30 & 31. As of Jan. 2, Maersk will pause all transits through the Red Sea and the Gulf of Aden until further notice and route vessels via the Cape of Good Hope where it makes the most sense for customers.

- Some carriers are pulling vessels from Transpacific strings and adding them to Asia-Europe strings to compensate for the effective decrease in capacity given the extended transit times around Africa.

- Vessels from Asia to North America East Coast and Europe will experience high utilization in upcoming weeks due to the longer transit time. Because of this, it is expected that most of the rate increases and surcharges announced by carriers will be implemented in full.

- Rates for non-United States destination lanes have increased rapidly, as they do not require a notice period by law. Rates for United States destinations will see a marked increase in the middle of January.

Updates on the Suez Canal: The Environmental Impact of Re-Routing, and What You Can Do

8 am ET / 5 am PT, Friday, December 29

The journey around the Cape of Good Hope from Asia to the US East Coast is about 25% longer than if a vessel were to transit the Suez Canal – it equates to about 7-10 extra days of transit time, which is 7-10 days more of fuel vessels are forced to use. As Lars Jensen, CEO and Partner of Vespucci Maritime discussed on a recent Flexport webinar, the sailing conditions around the Cape of Good Hope are tenuous; high winds along southern Africa can further slow vessels and increase fuel usage.

Outside of the shipping disruptions we’ve discussed, re-routing could increase a shipper’s environmental impact. To help mitigate this, Flexport is offering the following for all impacted customers:

- All Flexport LCL shipments are automatically offset, which is especially important since we estimate emissions will double from these routing changes.

- Customers will be able to see updated calculated emissions automatically in the Flexport Platform based on the actual shipment movement and re-routes once a shipment is delivered. This will be critical for accurate corporate or transport emissions reporting.

- Customers can also opt to reduce or neutralize those emissions with our comprehensive suite of climate solutions.

Updates on the Suez Canal: Some Carriers Begin Cautious Transits through the Canal

8 am ET / 5 am PT, Thursday, December 28

Carriers remain cautious about which ships will transit the Suez Canal instead of re-routing via the Cape of Good Hope as attacks on container and commercial vessels continue, as we saw with the MSC United VIII on Dec. 26. Thankfully there was minimal damage.

From what we’re hearing from our carrier partners, many will continue to divert vessels around the Cape of Good Hope to prioritize the safety of their crew. We expect the share of diverted vessels to further increase as vessels on the back-half of their journey east or west turn back towards the Suez and carriers need to make diversion decisions. Unless there’s a significant change in circumstances, we expect this to continue.

The x-factor here is Operation Prosperity Guardian and whether carriers believe the multi-national military coalition can keep their crew and cargo safe when transiting the Red Sea and Gulf of Aden. Maersk and CMA have made announcements that they are confident in the protection and have begun to route some vessels back towards the Suez Canal, but they remain cautious of the situation and will make swift changes when needed.

Callouts:

- Due to the longer transit times sailing south of the Cape of Good Hope, carriers have already announced blank sailings out of Asia in January in order to restore schedules. This will further impact available capacity.

- As of morning time Eastern on Thursday, Dec. 28, internal Flexport calculations and a review of Automatic Identification System (AIS) vessel data show about 350 vessels have diverted, are currently diverting, and/or plan to divert via the Cape of Good Hope.

- There are ~620 vessels on strings that regularly transit the Suez Canal, so roughly half have been diverted as of now. We expect this share to further increase as vessels on the back-half of their journey east or west turn back towards the Suez and carriers need to make diversion decisions.

- With the launch of Operation Prosperity Guardian, based on our data, about 14 vessels have bucked the diversion trend and continued or turned back to the Red Sea/Bab el-Mandeb Strait with plans to transit the Suez Canal. The vessels are operated by Maersk, CMA and COSCO with flags from Denmark (7), Singapore (3), Malta (2), Hong Kong (1), and the US (1). This highlights the fluid situation and varying approaches from carriers as other vessels for now appear to continue their route south of the Cape of Good Hope.

Updates on the Suez Canal: Operation Prosperity Guardian prompts carriers to resume service

10 am ET / 7 am PT, Tuesday, December 26

Maersk, CMA CGM and COSCO have resumed, in part, transiting through the Red Sea both eastbound and westbound, thanks to the launch of Operation Prosperity Guardian (OPG). OPG is the multi-national security initiative established to respond to Houthi-led attacks on shipping in the Red Sea.

According to Automatic Identification System (AIS) vessel data verified via Alphaliner and as of 10 a.m. ET on Tuesday, December 26, around 15 vessels had continued or turned back to the Red Sea / Bab el-Mandeb Strait. The vessel flags that have turned back span the world, including Denmark (7), Singapore (4), Malta (2), Hong Kong (1), and the US (1).

Updates on the Suez Canal: Carriers Say no Quick Resolution in Sight

5 pm PT, Thursday, December 21

One of the biggest unknowns in the Red Sea right now is how long the situation will last. Flexport is in constant communication with its ocean carrier partners, who have shared that they’re preparing for this to be a protracted situation unless there’s stronger, more concentrated efforts by governments.

As such, carriers are announcing new surcharges (e.g. War Risk Surcharge, Emergency Bunker Surcharge, Emergency Surcharge or a Peak Season Surcharge) on top of base rates to cover increased operational costs and risk. Some surcharges are added with immediate effect particularly for cargo loading or unloading at acutely impacted ports in the Middle East.

Some carriers that were previously routing Asia to the US East Coast sailings westward towards the Suez Canal will switch new sailings departing next week to transit the Panama Canal.

Updates on the Suez Canal: Delayed and Diverted Vessels Increase

1 pm PT, Wednesday, December 20

The number of delayed and diverted vessels that were originally bound for the Suez Canal has been steadily increasing. As of Wednesday, December 20, internal Flexport calculations and a review of Automatic Identification System (AIS) vessel data showed more than 170 vessels had been diverted south of Africa and about 35 had been delayed in the Red Sea.

As the situation is quickly unfolding, all Flexport customers are encouraged to track their shipments in real-time on the Flexport platform. To help our customers take action and quickly assess if they’re impacted, and by how much, Flexport’s engineering and product teams enhanced the map in every customer’s dashboard to automatically highlight any shipments on diverted or delayed vessels en route to the Suez Canal, as well as the ability to view more vessel details such as the vessel’s traveled route, status, destination, and when the data was last updated. This enhanced experience is integrated directly into every customer’s existing workflow so taking action and control of your supply chain is seamless.

Through the interactive map, customers will get near real-time updates on any impacted shipments thanks to Flexport’s extensive database of vessels and sailing schedule data, which allows us to model the transits through the Suez Canal. Using this data enables us to build models based on GPS positioning to determine if ships have decided to divert around the Cape of Good Hope or are idling in the Red Sea or Arabian Sea. Vessel locations are updated frequently thanks to Flexport’s mix of API and EDI integrations with data providers and transportation providers.

Flexport customers will also receive enhanced reporting that lists all containers impacted by the incident (accessible in every customer’s regular lists of reports). Together with the new map overlay, these features will provide an easy way for customers to keep checking whether or not they're impacted in near real-time.

For more information, watch Flexport ocean freight leaders and industry expert Lars Jensen, CEO of Vespucci Maritime in a webinar discussion with the latest updates and how global shippers can navigate on-demand here.

Updates on the Suez Canal: First Rate Increases Announced

6 pm PT, Monday, December 18

Carriers have begun sharing anticipated rate increases as result of the situation in the Red Sea. As a reminder, about 25% of effective capacity could be removed from impacted markets. Along with the increase in demand from the pre-Chinese New Year peak season, we expect rates to increase significantly, and fast, unless the situation resolves quickly, which seems unlikely.

Carriers shared price increase announcements for January 1, 2024 (in some cases, a 2x increase), and we expect these rates to stick. More increases are to be expected if this issue persists. With transit times extended 10-14 days due to rerouting around the Cape of Good Hope, carrier costs for fuel and crew will increase meaningfully. Additionally, with any service disruption, global shippers should expect base rates to increase as well as additional fees such as a War Risk Surcharge, Emergency Bunker Surcharge, Emergency Surcharge or a Peak Season Surcharge.

For comparison, rates on the Asia to North Europe trade lane for January 1 have been announced at more than $3,000 per container. While the Ever Given was stuck in the Suez Canal during the height of Covid, rates climbed up to $20,000 per container relative to the historical average of $1,500 per container.

A downstream effect we’re closely monitoring is any possible equipment shortage (e.g. trucking trailers or chassis needed to move containers once they reach their final destination) on the Asia to Europe trade lane in the second half of January as a result of vessel re-routings. An equipment shortage could spur a price increase due to lack of supply.

Updates on the Suez Canal: Impacts to Global Transit Times

9 am PT, Monday, December 18

As of Monday, December 18, all major ocean carriers besides OOCL and COSCO have announced they’ll pause all vessels bound for the Suez Canal via the Red Sea and Bab-el-Mandeb Strait.

Global importers should expect the following transit delays:

It’s currently estimated that re-routing via the Cape of Good Hope will prolong transit times by 7-10 days, but it depends on where the vessel is when the re-routing decision has been made. Depending on the vessel’s location, some may experience an even longer delay of 2-4 weeks if they’ve had to detour from the Red Sea. For example:

- Shanghai to Rotterdam via Suez is ~11,000 nautical miles, while via the Cape of Good Hope is ~14,000 nautical miles. Assuming an average vessel speed of 16 knots, that’ll prolong transit times by 8-10 days. For reference, most ships can do up to 22 knots but it becomes uneconomical beyond 16 knots.

- Shanghai to Genoa, Italy via Suez is 8,600 nautical miles, while via the Cape of Good Hope is 13,500 nautical miles. Assuming an average vessel speed of 16 knots, that’ll prolong transit times by 11-13 days.

- For vessels bound for Rotterdam that are currently in the Gulf of Aden and are being diverted around the Cape of Good Hope, the incremental transit time is ~13 days.

- For vessels bound for all other Northern Europe (NEUR) destinations that are being diverted around the Cape of Good Hope before entering the Red Sea/Indian Ocean, the incremental transit time is 7-10 days. Vessels already at the Red Sea that need to be re-routed can expect transit times of ~14 days (this is due to days lost traveling from the Indian Ocean to the Red Sea and then from the Red Sea to the Cape of Good Hope).

The Cape of Good Hope is a windy passage, so vessels typically follow a specific route to avoid too much wind even in the middle of the sea. If the traffic is heavy along the passageway, then vessels will likely need to slow down.

Updates on the Suez Canal: Alternative Options for Imports to US East Coast

11AM PT, Sunday, December 17

Mediterranean Shipping Company (MSC) officially announced it will pause all vessels bound for the Suez Canal via the Red Sea and Bab-el-Mandeb Strait, joining CMA CGM, Maersk, Hapag-Lloyd and ZIM.

For US importers shipping cargo from Asia to US East Coast ports, Flexport recommends the following options to keep your goods moving efficiently and to minimize disruption to your supply chain.

- Consider booking your ocean freight shipments to the US West Coast and then transloading via rail or truck to your final destination.

- Limited capacity is still available for shipments to transit the Panama Canal. Despite low water levels and the reduction in traffic, this is still a viable route for many US importers.

- For time sensitive shipments, specifically those originating from Central and South China, opt for premium or expedited services.

Given a potential 25% decrease in effective capacity along with the pre-CNY peak season, we expect rates to increase significantly and fast unless the situation resolves. Please work with your dedicated Flexport account team to assess all options for alternative routings to keep shipments moving.

Updates on the Suez Canal

5PM PT, Saturday, December 16

CMA CGM is the latest global ocean carrier to announce it will pause all vessels bound for the Suez Canal via the Red Sea and Bab-el-Mandeb Strait due to heightened security concerns and for the safety of crew members. CMA CGA joins Maersk, MSC, Hapag-Lloyd and Zim; collectively, these carriers account for 70% of Suez Canal-bound capacity.

Flexport is closely monitoring the situation and in communication with its carrier partners. If this situation persists, in a worst case scenario about 25% of global capacity would be removed from the market as vessels are forced to sail around the Cape of Good Hope, extending transit times and lengthening the amount of time it takes for each vessel to complete its voyage.

As we previously shared, many carriers had elected to re-route vessels through the Suez Canal on the FEWB and TPEB to the US East and Gulf Coasts due to a persistent drought in Panama. To quantify the impact, about 35% of the TPEB US East and Gulf Coasts volume has shifted from the Panama to the Suez Canal, and vessels could be forced to re-route again.

What should shippers do?

1. Current shipments on the water: Flexport will provide updates as soon as possible. Carriers are assessing the situation and evaluating all of their options.

2. Shipments currently booked: Keep expected plans and push to load on schedule. As space will likely be tight in January before the Chinese New Year, it’s best to keep scheduled load plans in December, though total transit might be delayed by 7-10 days for cargo going to the U.S. East Coast.

3. Looking ahead: Between slowdowns along the Panama Canal due to drought and the current situation in Suez – not to mention the Lunar New Year in February – we recommend booking cargo 4-6 weeks in advance to make sure a plan can be put in place for cargo. For Flexport customers with urgent POs, reach out to your dedicated account team to discuss premium and/or expedited options via the US West Coast.

The Current Situation

5PM PT - Friday, December 15

This week’s drone and missile attacks on commercial ships in the Red Sea and Bab-el-Mandeb strait have prompted global ocean carriers to take precautions to protect the safety of crew members. While thankfully there have been no reports of injury or death, the situation is evolving quickly.

The strikes are targeting one of the world's busiest routes for fuel and container shipments, impacting the Bab-el-Mandeb strait, which is crucial for vessels traveling to and from the Suez Canal. Carriers are assessing the security situation and taking steps to protect crews, and so far Maersk has officially announced a pause on container traffic in the Red Sea.

As a result of the attacks, some carriers are rerouting shipments around the Cape of Good Hope in southern Africa, which could prolong transit times by 7-10 days. This will impact vessels moving goods from Asia to Europe and the eastern United States.

The Global Impact on Logistics

Flexport is in constant communication with its carrier partners to determine the impact on vessels, and will provide consistent updates.

While our recommendations may change as events unfold, Flexport is making the following recommendations:

1. Current shipments on the water: Flexport will provide updates as soon as possible. Carriers are assessing the situation and evaluating all of their options.

2. Shipments currently booked: Keep expected plans and push to load on schedule. As space will likely be tight in January before the Chinese New Year, it’s best to keep scheduled load plans in December, though total transit might be delayed by 7-10 days for cargo going to the U.S. East Coast.

3. Looking ahead: Between slowdowns along the Panama Canal due to drought and the current situation in Suez – not to mention the Lunar New Year in February – we recommend booking cargo 4-6 weeks in advance to make sure a plan can be put in place for cargo.

It’s too early to determine the impact this will have on international shipping, and is worth noting that the situation is evolving quickly. The Suez Canal is a critical artery in global logistics, and as seen during in March 2021 when the Evergiven ran aground, blockages can cause global backlogs of container vessels and shipping delays for everyday goods around the world.